How to Add Money to Your Chime Account

By Chime Team

January 13, 2021

Whether you're new to Chime or just haven't had the chance to fully explore the app yet, you might be wondering: "How do I deposit money into Chime?" or "How do I transfer money into Chime?"

Well, step right up, because we've made the process as simple as possible. Here's a quick rundown of how to move money into Chime — and how to start unlocking perks with direct deposit.

- How do I set up direct deposit?

- Benefits of setting up direct deposit with Chime

- 3 more ways to move money into Chime

- Welcome to Chime 💚

If you set up direct deposit with Chime, you'll start unlocking more awesome features in the app. See below for more details.

Here's how to get started:

- Log into the Chime app, and tap on the gear icon to open Settings.

- Scroll to Account Information and tap on "Set up direct deposit."

- Check your email and print the attached form.

- Complete, sign, and submit the form to your employer. You should start receiving direct deposits within two payment cycles!

As long as your employer offers direct deposit as an option, it's a cinch to set up. If you're out of work, you can also receive unemployment benefits via direct deposit . Don't have a printer? You can use HelloSign to complete, sign, and email the form to your employer — all from your phone.

Alternatively, if you have access to your payroll or benefits account online, you can set up direct deposit by logging in there and entering your Chime Spending Account routing and account numbers (also located under Settings —> Account Information).

P.S.: If you'd like a little more guidance, this article dives deeper into the details of setting up direct deposit with Chime. 🤑

Not only is direct deposit a simple and hassle-free way to get paid, but when you do it with Chime, you'll be eligible to unlock a slew of extra perks, such as:

- Get paid early¹ : Gain access to your paycheck up to two days early

- SpotMe² : Overdraft up to $100 on debit card purchases with NO fees (as long as you're receiving at least $500 per month in qualifying direct deposits).

- Chime Credit Builder Visa® Credit Card : Chime members have been able to increase their credit score by an average of 30 points.³

- Save When I Get Paid⁴ : Automatically save a portion of each paycheck, and watch your rainy day fund grow!

- Mobile check deposit⁵: Easily deposit paper checks via the Chime mobile app.

Not eligible or interested in setting up direct deposit with Chime? No problem. Here are three other ways to move money into Chime.

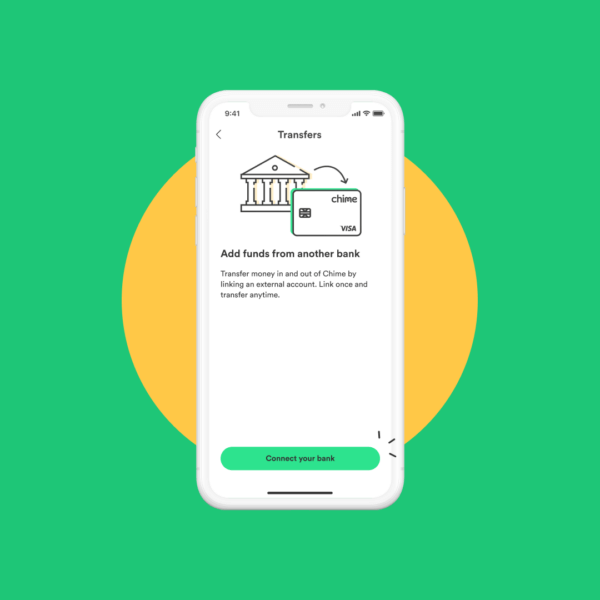

1. Make an instant transfer⁶

This option is available the first time you add money to your Chime Spending Account. All you have to do is link an external bank account, and add your debit card number, then you'll be able to add up to $200–instantly.

2. Transfer from a major bank

This option works if your account is at one of the following banks: Bank of America, Capital One 360, Charles Schwab, Chase, Citi, Fidelity, Navy Federal, PNC Bank, SunTrust, TD Bank, USAA, US Bank, or Wells Fargo.

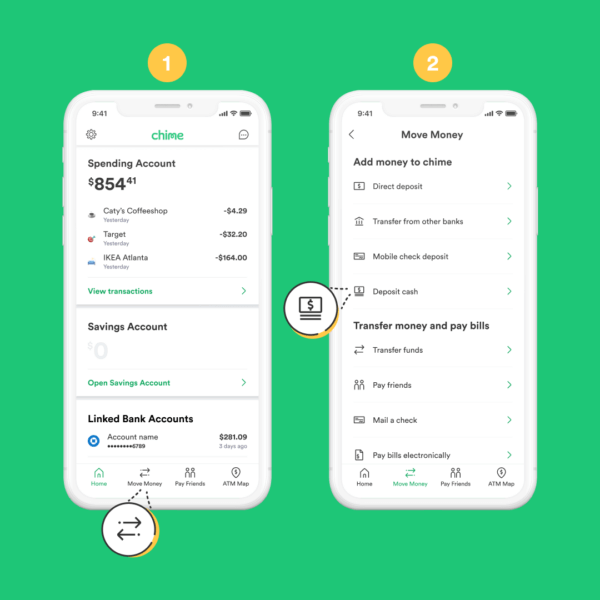

Here's how:

- Log into the Chime app and click "Move Money" —> "Transfers."

- Enter the username and password for your other bank (don't worry; it's encrypted!).

- Transfer your money: up to $10,000 per day and $25,000 per month for most members. You'll have access to the funds within five business days.

3. Transfer from another account

If you're using a bank that's not listed above, or you want to transfer a larger amount of money, worry not. You can also move money from your old bank.

Here's how:

- Log into your old bank's website or app.

- Look for a menu item that says something along the lines of "transfer funds" or "add external account."

- When prompted, add your Chime routing and account number (which you'll find under Settings within the Chime app).

While the transfer time will depend on your old bank's policies, you'll usually see the money in your Chime Spending Account within a few business days.

4. Deposit cash⁷

If you don't have another bank account, or simply want to deposit cash into your Chime Spending Account, you can do so at more than 90,000 retailers, including many Walmart, CVS, and 7-Eleven stores.

Here's how:

- Log into the Chime app and click "Move Money" → Deposit Cash

- The map will direct you to nearby retail locations where you can tell the cashier you'd like to deposit cash into your Chime account. You can deposit up to $1,000 every day or $10,000 every month, though retailer limits may vary.

☝️ Heads up: As these third parties might impose their own fees or transaction limits, be sure to get all the info before proceeding.

Wondering about wire transfers? While we don't allow those yet, we hope to add them in the near future.

Whichever way you choose to move money into your Chime account, we're just happy to have you join the community! And no matter where you're at in your money journey, we're here for you every step of the way.

¹Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

²Chime SpotMe is an optional, no fee service that requires $500 in qualifying direct deposits to the Chime Spending Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases initially, but may be later eligible for a higher limit of up to $100 or more based on member's Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime's discretion. SpotMe won't cover non-debit card purchases, including ATM withdrawals, ACH transfers, Pay Friends transfers, or Chime Checkbook transactions. See terms and conditions

³Based on a representative study conducted by TransUnion®, members who started using Chime Credit Builder in September 2019 observed a median credit score (VantageScore 3.0) increase of 30 points by January 2020. Impact to score may vary, and some users' scores may not improve.

⁴There may be times when instant digital payments may be delayed due to timing or other factors. See more details here

⁵ When you deposit cash to your Chime Spending Account, it is transferred by a third party to your account. Your funds will be FDIC insured once the bank holding your account receives the funds from the third party.

⁶ There may be times when instant digital payments may be delayed due to timing or other factors. See more details here

⁷ When you deposit cash to your Chime Spending Account, it is transferred by a third party to your account. Your funds will be FDIC insured once the bank holding your account receives the funds from the third party.

How to Add Money to Your Chime Account

Source: https://www.chime.com/blog/chime-basics-how-to-move-money-into-chime/

0 Response to "How to Add Money to Your Chime Account"

Post a Comment